To add Pay Later offers to an integration with a third-party commerce platform, see Commerce Platforms.

For information about how you can use PayPal’s JavaScript SDK for a low-code Pay Later integration, see Get started with Pay Later.

To add Pay Later offers to an integration with a third-party commerce platform, see Commerce Platforms.

For information about how you can use PayPal’s JavaScript SDK for a low-code Pay Later integration, see Get started with Pay Later.

Features

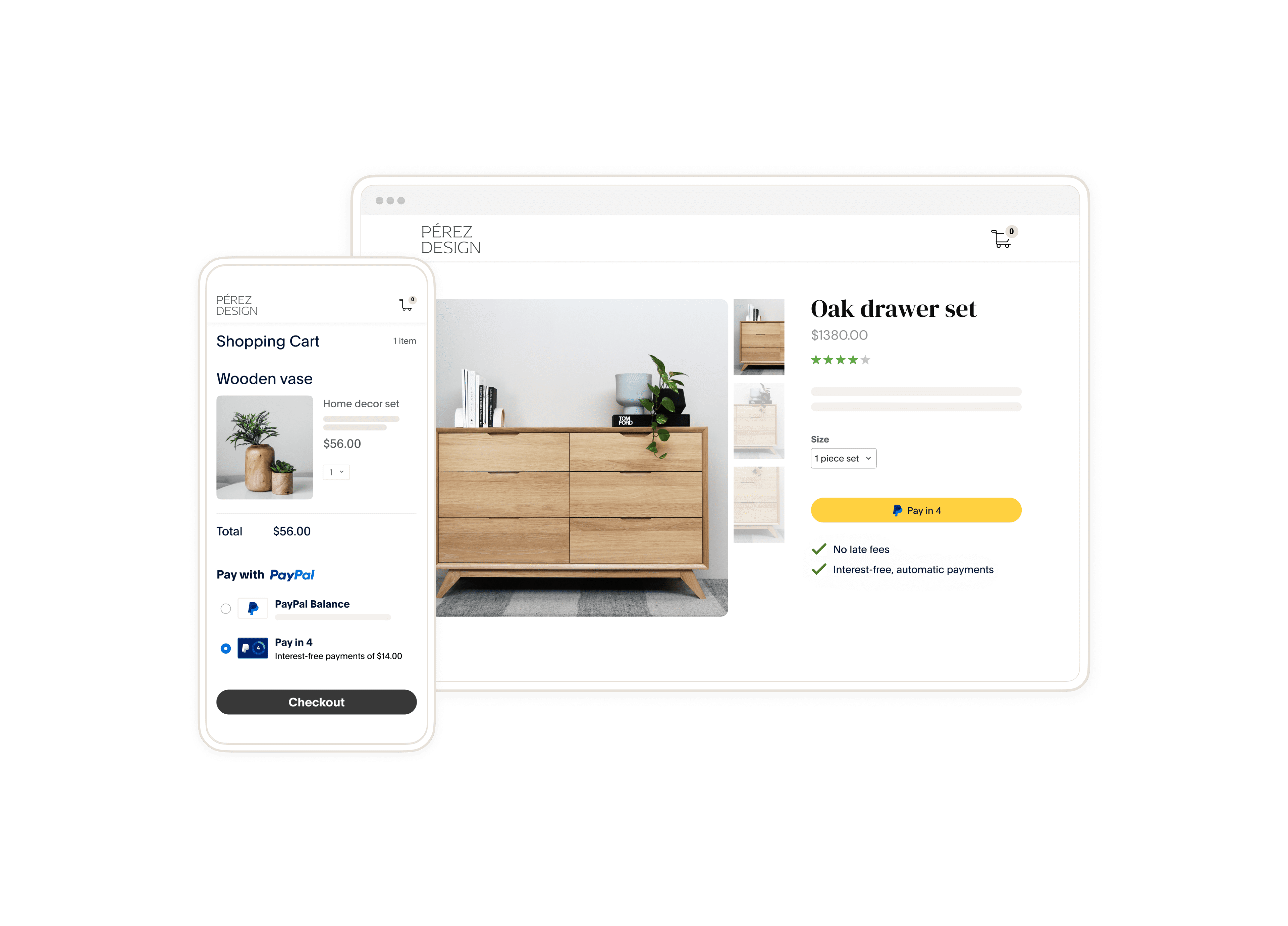

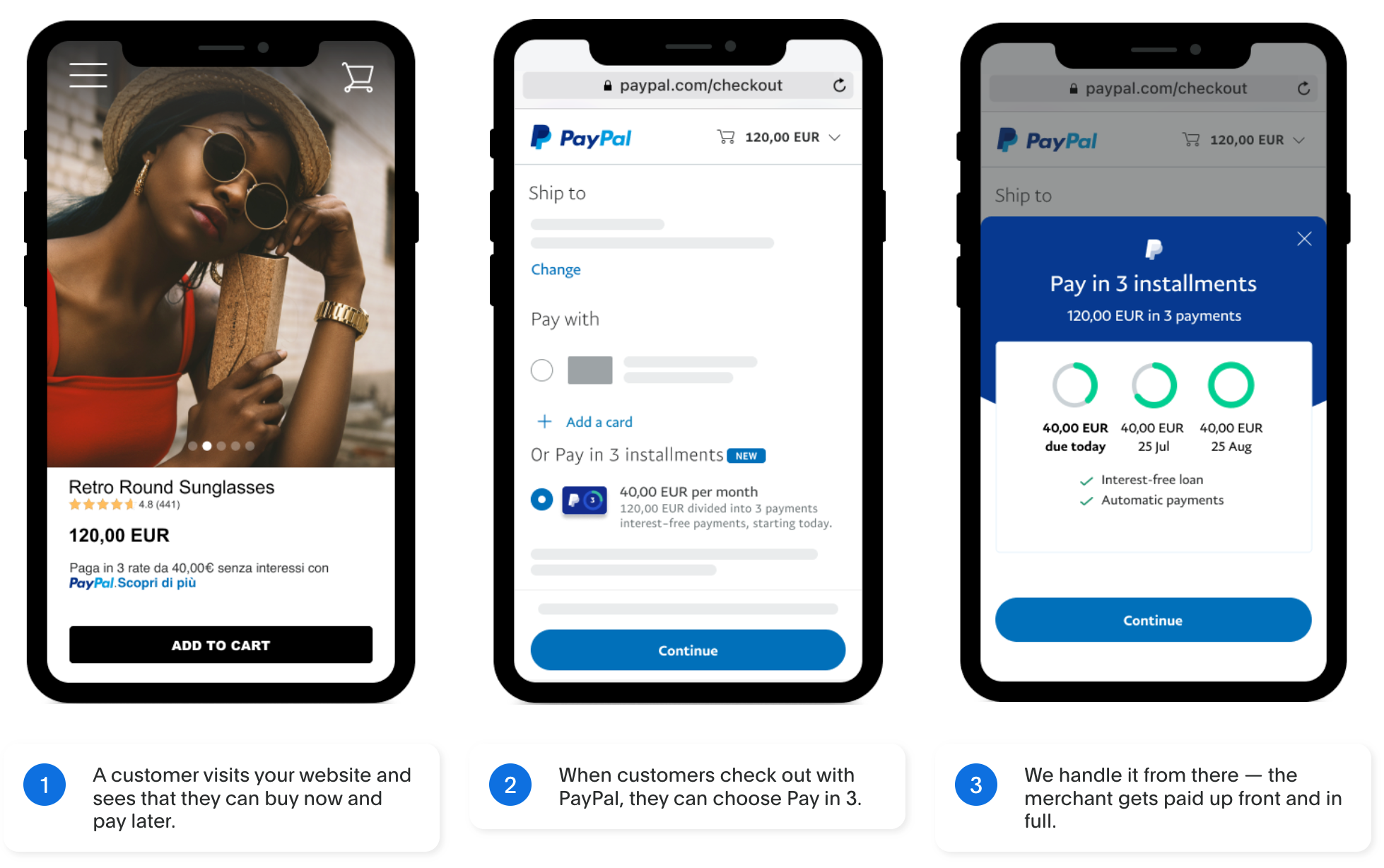

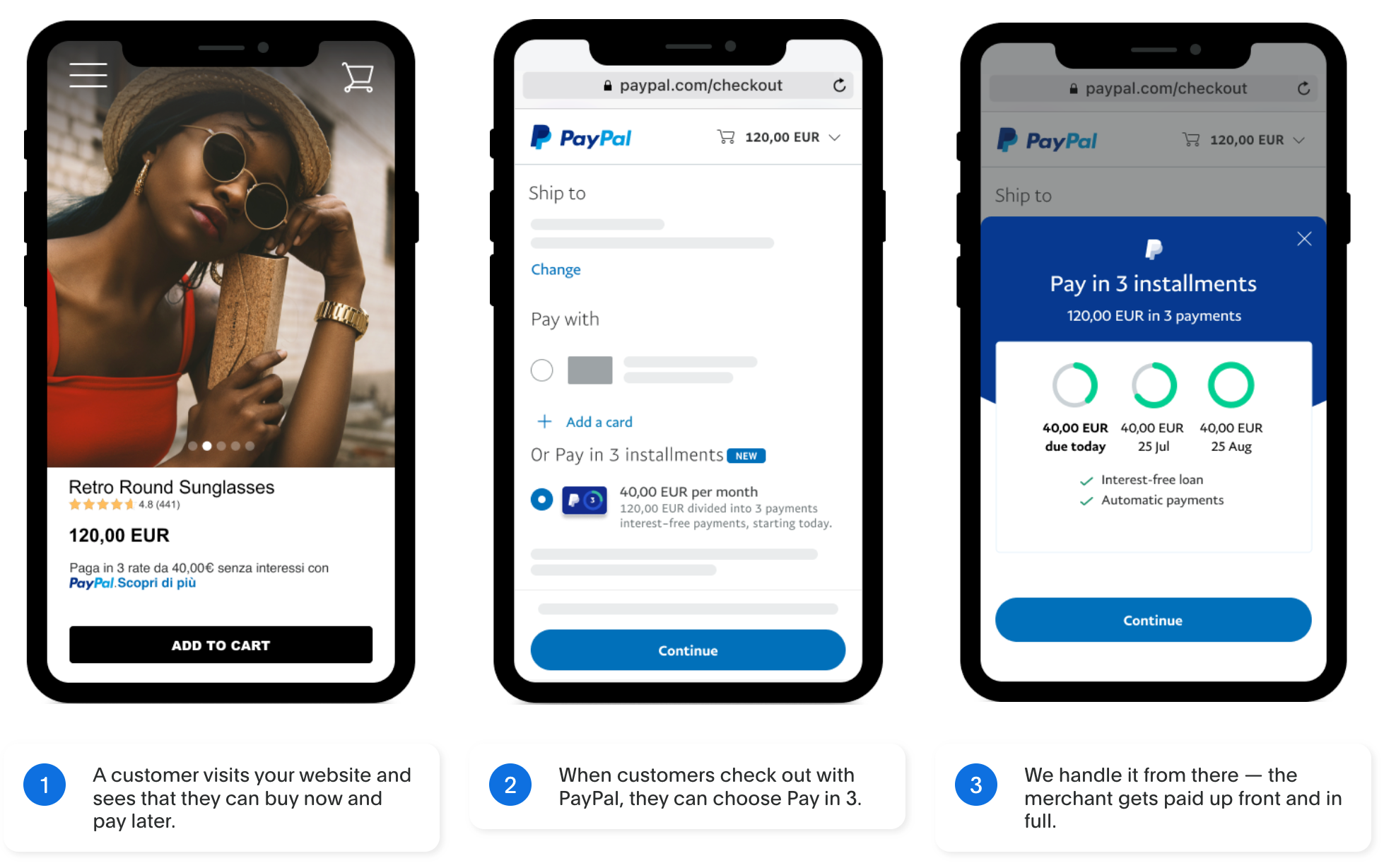

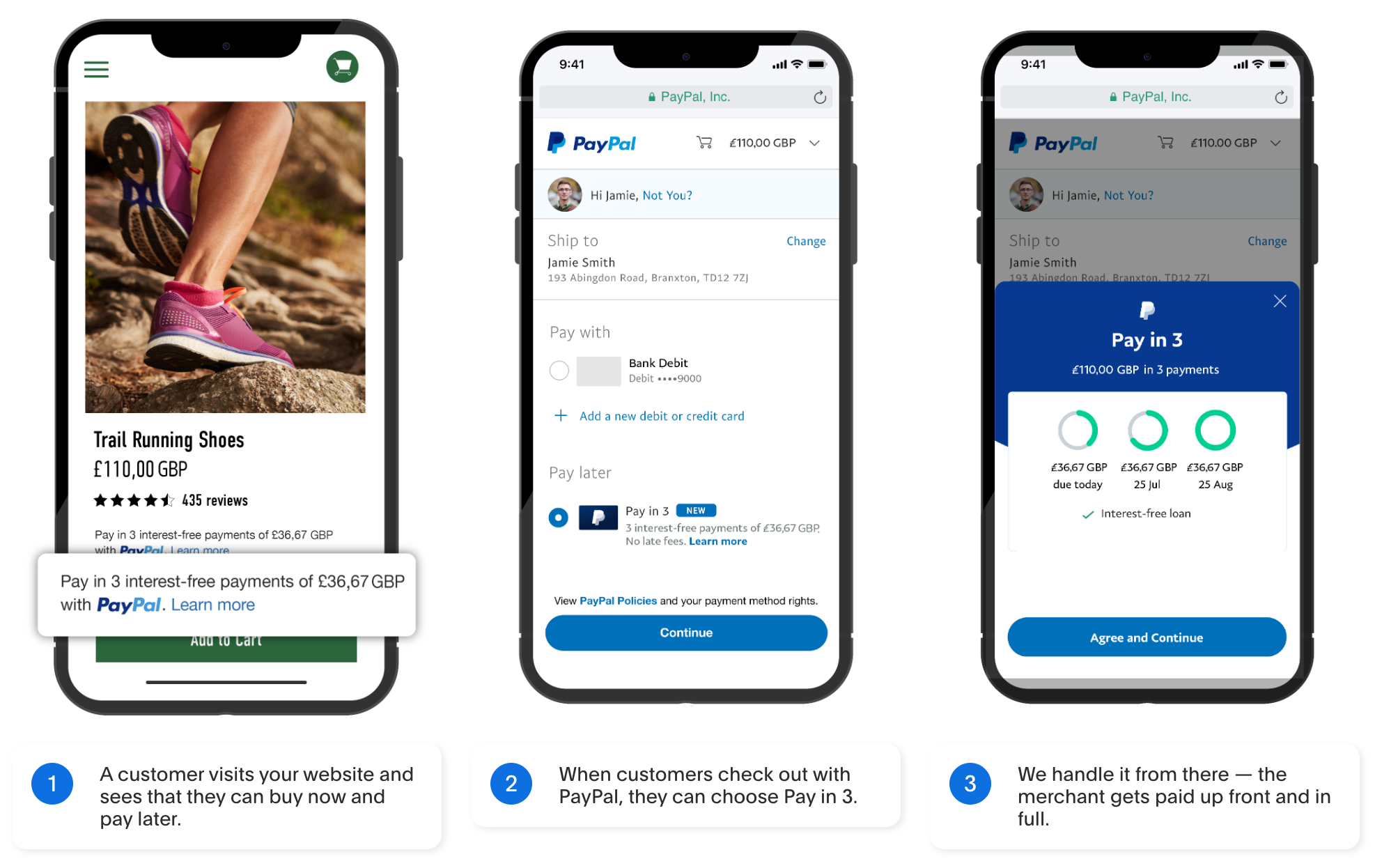

With Pay Later, you can get:- Increased conversion: Adding “buy now, pay later” messaging to your site can improve conversion, attract new customers, and increase order values.

- Dynamic messages: You can show your customers a Pay Later offer that is based on the contents of their shopping cart.

- Multiple touch points: Add messaging throughout your site such as on product pages, the shopping cart, and checkout pages.

Country-specific details

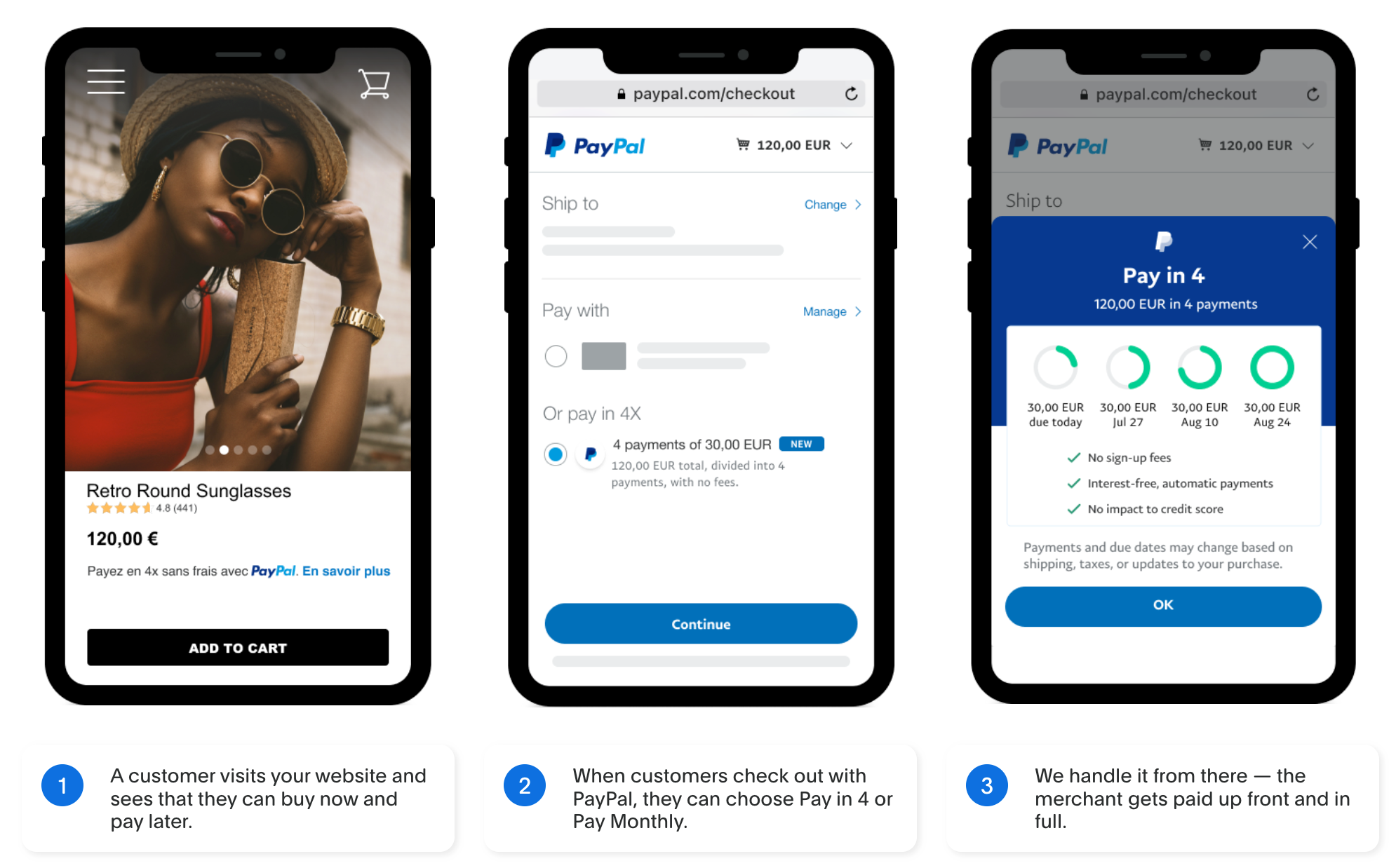

For information about country-specific Pay Later offers, select a tab.- United States

- Australia

- France

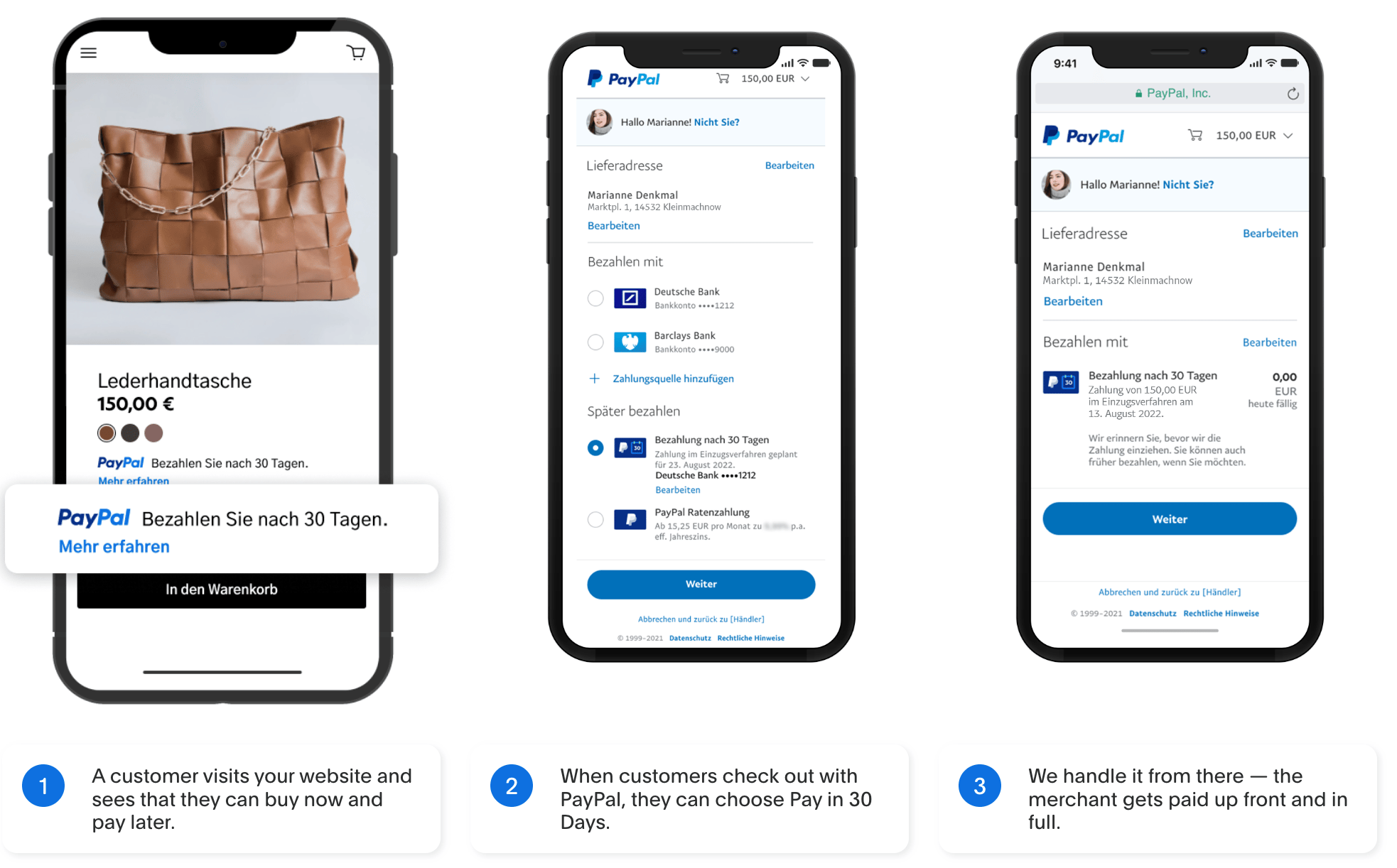

- Germany

- Italy

- Spain

- United Kingdom

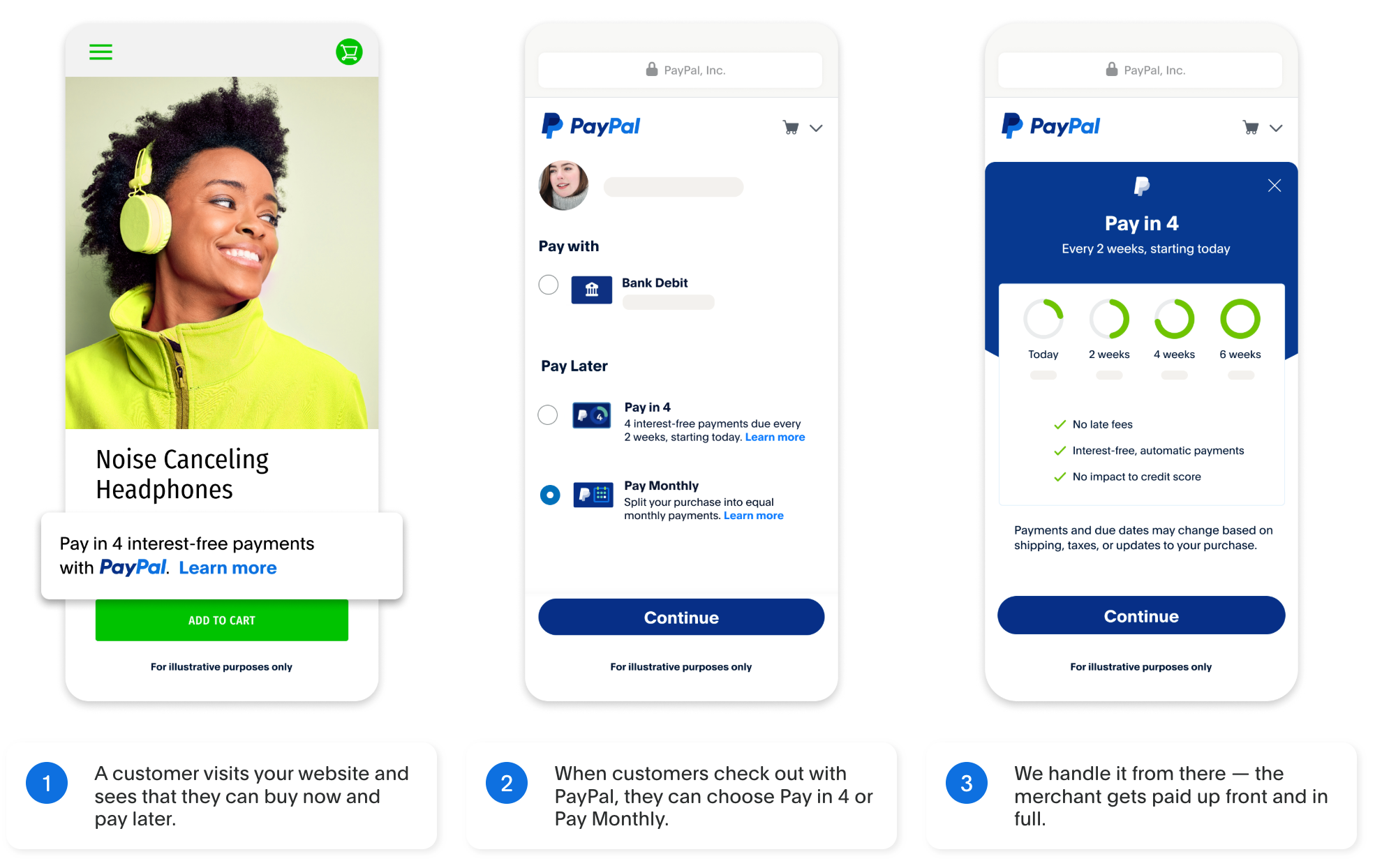

PayPal offers special financing options that payers can use to buy now and pay later, while merchants get paid upfront. For more information about Pay Later, see Buy now, pay later.

EligibilityYou’re eligible to integrate Pay Later offers in the US if you meet all of the following requirements:

EligibilityYou’re eligible to integrate Pay Later offers in the US if you meet all of the following requirements:

| Product | Number of payments | Due | Purchase amount |

|---|---|---|---|

| Pay in 4 | 4 | Every 2 weeks (biweekly) | $30 to $1,500 |

| Pay Monthly | 3, 6, 12, or 24 | Monthly | $49 to $10,000 |

EligibilityYou’re eligible to integrate Pay Later offers in the US if you meet all of the following requirements:

EligibilityYou’re eligible to integrate Pay Later offers in the US if you meet all of the following requirements:- Are a US-based PayPal merchant.

- Have a US-facing website.

- Transact in US dollars (USD).

- Have a one-time payment integration, and Pay Later options are available through PayPal checkout.

- Abide by the Pay Later Messaging Center Program Terms.

- Do not edit Pay Later messages with additional content, wording, marketing, or other materials to encourage the use of this product or remove any content. Render the Pay Later messaging in its entirety with all the links and language provided by PayPal. For noncompliant messaging, PayPal reserves the right to take action in accordance with the PayPal User Agreement.

- Do not create, display, or host your own Pay Later content. Instead, integrate only the official code that PayPal provides.

Notes:See also

- Reference Transaction and Recurring Payment integrations aren’t eligible for Pay Later offers.

- Pay in 4 loans to CA residents are made or arranged pursuant to a CA Financing Law License. PayPal, Inc., is a GA Installment Lender Licensee, NMLS #910457. RI Small Loan Lender Licensee.

- A Pay Monthly agreement is subject to consumer credit approval. Term lengths and fixed APR of 9.99-35.99% vary based on the customer’s creditworthiness. The lender for Pay Monthly is WebBank. PayPal, Inc. (NMLS #910457): RI Loan Broker Licensee. VT Loan Solicitation Licensee.